We can advise a client on the widening array of on-site generation, grid battery and power optimisation innovation options becoming available. Also offer provisional financial modeling on embedded generation and storage options. Should our model suggest that investment may be worthwhile to explore further, we could provide a formal investment analysis and potentially prepare a solar PV, battery or other asset design configuration to match the client’s energy trading or usage and specific security of supply needs.

Our ‘know how’ in terns of power optimisation, demand side and supply management covers a range of technologies and manufacturers. In the first instance, we outline to the client ‘the pros & cons’ we see from the client’s perspective of each technology option. If requested then run economic model to test if there is sufficient value added potential to merit further investigation, explaining frankly the practical draw-backs, constraints as well as cost-saving or revenue-raising potential which we may see applying.

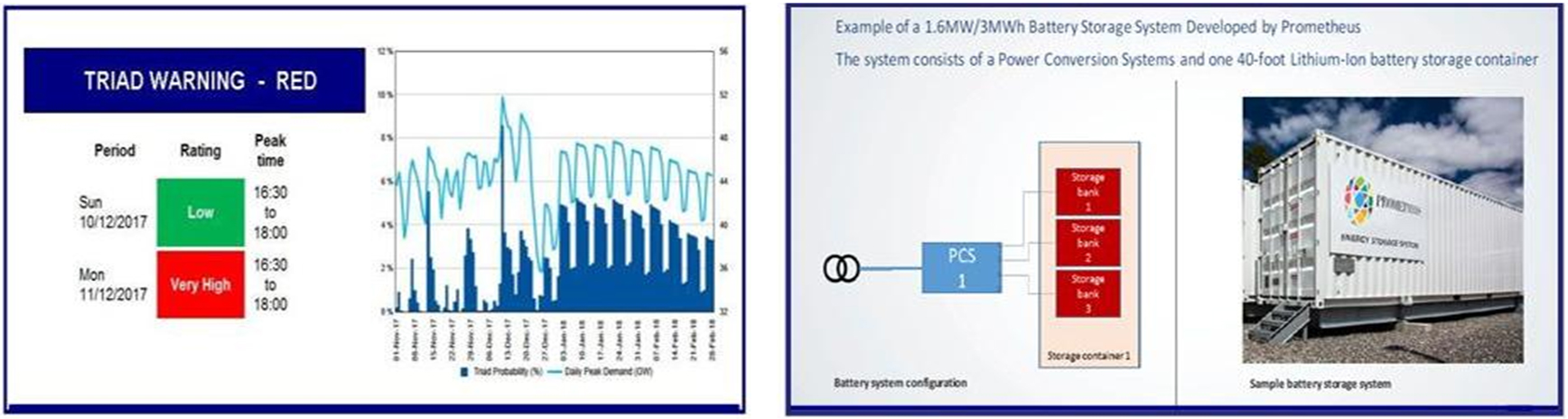

To clients without the scope to look at on-site generation or storage we can still provide essential energy management and cost-saving which will reduce energy expenditure and carbon footprint. Our demand side management service (which may be included with our Gas and Electricity Purchasing service) involves the issue of Triad Warnings to help clients avoid inadvertent increases in energy bills; also extensive past & present energy bill checking & reclaiming services, all of which is included; as well as other solutions applicable that can reduce the client’s annual energy bill as far as possible.

Above are actual examples of Triad price alert warnings we issue clients and a Prometheus (Zero CAPEX Cost) lithium-ion battery storage solution which can be used to reduce a company’s net energy costs (by guarantee), also improve power quality and security of supply on site.